pay ohio unemployment taxes online

Report it by calling toll-free. JFS-20125 UC Quarterly Tax Return.

Ohio Unemployment Oh Benefits Eligibility Claims

When you apply you will need.

. Reporting their unemployment tax liability as soon as there are one or more employees in covered employmentThis may be done at thesourcejfsohiogov or by completing the JFS 20100. True Coronavirus and Unemployment Insurance Benefits Resource Hubs Please review our employee and employer resource hubs for more information on unemployment benefits. Click here if you have paid wages under covered employment or if you have an.

Unemployment benefits paid to eligible claimants are. Payments by Electronic Check or CreditDebit Card. Payments by Electronic Check or CreditDebit Card.

For general payment questions call us toll-free at 1-800. File for benefits online or by phone 247 including expanded benefits for those impacted by COVID-19. The Ohio Business Gateway is another option available to submit current quarter unemployment reports and payments.

Several options are available for paying your Ohio andor school district income tax. The Gateway populates previously reported employees and wage data. The Department of Taxation issued the tax alert Ohio Income Tax Update.

The agreement form may be. Several options are available for paying your Ohio andor school district income tax. You can apply for unemployment benefits online at the ODFJS website.

An official State of Ohio site. Welcome to the Ohio Unemployment SOURCE application. However its always possible the amount could change.

Up to 25 cash back That amount known as the taxable wage base has been stable at 9000 in Ohio since the year 2000. The Newark Income Tax Office offers a program that allows employers to submit payments through an ACH credit file. Welcome to the Ohio Unemployment SOURCE application.

If no previous payments were made via EFT with the Ohio Treasurer of State some taxes must complete the EFT Agreement Form. Used by employers to submit quarterly wage detail and unemployment taxes. Starting August 9 2022 the Ohio Department of Taxation ODT will begin mailing non-remittance billing notices to taxpayers who have not paid in full their 2021 Ohio individual andor school.

Welcome to The SOURCE. E1 A small farm winery shall collect all. To participate in this program your bank must be able to process an.

For general payment questions call us toll-free at 1-800. You may apply for a waiver of these assessments. Once the missing Quarterly Tax Return is processed you will be assessed penalty and interest.

Please be advised that the State of Ohio Unemployment Resource for Claimants and Employers SOURCE will be unavailable. What are the consequences of failing to file or pay. On Employer Login page select and click Register to maintain TPA account online link.

Your Social Security number and drivers license or state ID number. To register as the Employer Representative click on the Create a New Account button below. Should you have any questions please call.

To submit your quarterly tax report online please visit. Ohios New Unemployment Insurance Tax System Select who you are Employers. Please be advised that the State of Ohio Unemployment Resource for Claimants and Employers SOURCE will be unavailable.

File Unemployment Taxes Online.

Unemployment Base Period Chart Fill Online Printable Fillable Blank Pdffiller

Ohio Unemployment Compensation Benefits Gov

Struggling To File Your Unemployment Claim Here S Why

How Criminals Stole Billions Meant For Unemployed Americans

Ohio Officials Expect Tax Season Will Reveal Widespread Identity Theft To Unsuspecting Victims

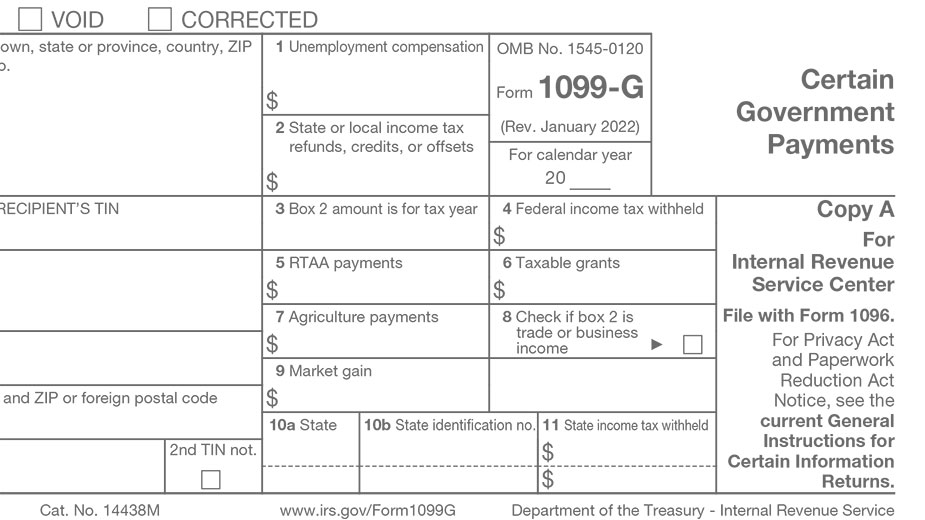

Ohio Targets Fraud As 1099 G Tax Form Distribution Begins Business Journal Daily The Youngstown Publishing Company

Ohio Unemployment Fraud Suspected In Surge Of Claims

Unemployment Fraud Fulton County Oh Official Website

Pay Online Department Of Taxation

Coronavirus In Ohio How To Apply For Unemployment If You Ve Been Impacted By Covid 19 Nbc4 Wcmh Tv

Can I Apply For Ohio Unemployment Benefits If I Am Self Employed Wtol Com

Ohio Income Taxes Unemployment Benefits From 2020 Won T Be Taxed For Most Filers

Michigan Unemployment 2021 Tax Form Coming Even As Benefit Waivers Linger Bridge Michigan

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Frustrations Mount As Unemployment Backlog Continues In Ohio Kentucky Wkrc

Ohio Unemployment Ein Number Fill Online Printable Fillable Blank Pdffiller

Record Number Of Ohioans Apply For Receive Unemployment As Access Issues Continue Wsyx